Offering your customers multiple payment solutions is no longer a good-to-have option but a must-have. It differentiates you from the competition and encourages customers to purchase more by enhancing their buying experience and making it enjoyable. Also, thanks to current technological advancement, there are numerous online payment methods – which we will explore in this blog.

In today’s digital economy, offering a smooth and secure online payment experience is no longer a luxury. Whether you run an eCommerce store, a subscription-based service, or a brick-and-mortar business expanding into digital sales, enabling your customers to select the best online payment method for their transactions is essential for driving growth and building customer trust. Online shopping has rocketed recently, especially during the global pandemic when eCommerce sales increased to over 27%. Also, with global eCommerce sales reaching nearly $6 trillion in 2024, this growth is steady and consistent.

After all, with 4.54 billion internet users, it is no wonder that preference for online shopping is increasing among consumers. Hence, offering the right payment solutions can make or break your business. From fast, user-friendly checkout options to secured gateways that protect sensitive data – the right payment solutions enable streamlined transactions and reduced cart abandonment, making it an amazing journey for your customers.

Let’s explore some of the key payment solutions for your business today.

Understanding the Types of Online Payment Solutions

The advent and rise of multiple digital payment solutions have further facilitated the consistent rise in online shopping and eCommerce. Is it surprising that global digital payments are projected to reach $14.78 trillion by 2027?

The following are the major types of online payment systems that you can offer your customers:

- Credit card – The oldest and still the most popular online payment system.

- Direct debit – It enables your customers to make a payment without using a credit card. Some options include – Sepa Direct, Multibanco, Giropay, and others.

- Bank transfer – Applications such as Trustly make it simple for your customers to pay through bank transfer, as it takes them directly to their banking apps to complete the payment.

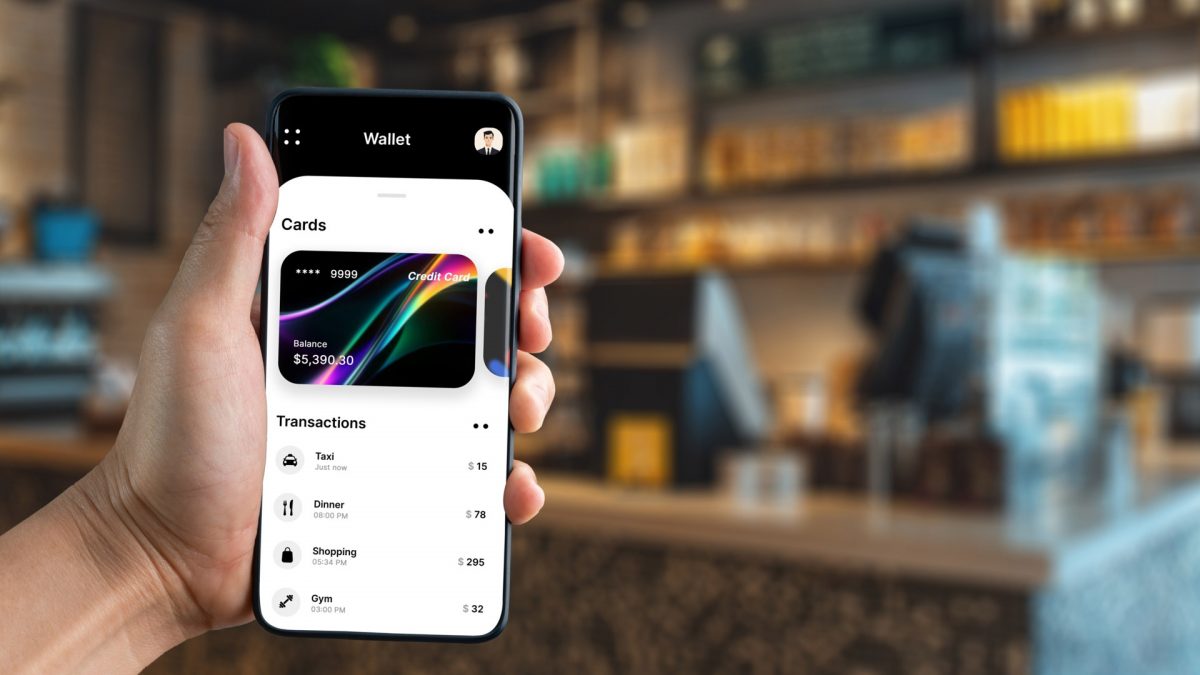

- Digital wallet – Payment options such as Google Pay, Apple Pay, and PayPal are some digital wallet options that keep customers’ payment information secure by adding an extra layer of protection. It helps build customer trust.

- Peer-to-peer payment apps – These apps have gained popularity recently as they help people transfer money without papers on hand. Examples are Bizum and SOFORT.

- Installment/Pay-later apps – You can provide your customers the option to pay in some mutually agreed installments based on your business type. Examples of such apps could be Cofidis and Klarna.

Top Online Payment Solutions to Power Your Business

Now that we are aware of the types of payment solutions, here are some of the key solutions you should offer to your customers to thrive in this dynamic online retail marketplace:

• Paypal

It is one of the most widespread payment solutions, with 305 million active users, and is still growing. You can withdraw funds in around 202 countries in around 56 different currencies. The best part of PayPal is that it is user-friendly, free to use, and can be used to access multiple debit and credit cards.

• Stripe

Similar to Paypal, Stripe is equally user-friendly and doesn’t require any monthly/membership fees. Also, due to some of its special features and tools, it is the best solution if you require a customized payment platform.

• Amazon Pay

You can easily reach out to Amazon users and pay for purchases by logging into your account and using Amazon Pay. Easy to set up with your site, it can be optimized for mobile and voice search. Additionally, it allows your customers to access numerous sites with one account.

• X-Payments

You can use X-Payments if your customers’ financial safety and privacy are your main concerns. This payment solution is certified by PCI DSS, and thus, you can offer your customers the highest level of safety. It can process approximately more than 40 credit cards.

• Braintree

Owned by PayPal, Braintree focuses on mobile users and leverages the PayPal network and Next-Gen technology to help you expand the market. So, if you are confused about opting for PayPal or Braintree, you need to strategically analyze what these solutions offer and which one aligns best with your business.

• GoCardless

This payment solution is the most suitable if you are into a subscription business collecting recurring customer payments. Using GoCardless also enables you to track your customers’ payment status. The basic subscription is free; however, you can opt for the paid version if your business demands it.

• Adyen

In 2019, Adyen won the Nora Solution Partner Excellence Award for Best Security and Anti-Fraud Solution. With availability in almost 200 countries, it supports around 250 local payment methods. It is trusted by huge companies such as Microsoft and Spotify as their trusted payment solution.

Conclusion:

To sum it up, we know the significance of offering multiple payment solutions to customers to make your business thrive and prosper. Through a secure, smooth, and flexible online payment option, you can differentiate yourself from the competition and help you establish long-term loyalty among your customers. Multiple payment methods ensure a seamless checkout experience.

Moreover, with the advancement of technology and shift in customer preferences, your business will benefit from newer options such as Buy Now, Pay Later (BNPL), and even cryptocurrency payments. This is not merely about offering payment solutions but about offering the right kind to your customers while also protecting their data. You should focus on scalability and flexibility with those investments to accommodate growth in your business. After all, proper payment strategy investments directly pay dividends for you and your customers in terms of easier and safer transactions.

If you are looking for a professional partner to help you provide a variety of payment methods to your customer, Connect with XPDEL and we will be happy to help.

About XPDEL:

XPDEL is not another 3PL supply chain and logistics provider. We help eCommerce brands accelerate their growth, empowering them with multi-channel fulfillment, whether shipping directly to consumers, delivering to businesses, or selling through retail stores. Powered by advanced technology and led by industry experts, we thrive on data and insights for making smart business decisions.